District of Carleton North accuses province of ‘passing the buck’

Many New Brunswickers opened their mail to significant property assessment increases in January. All over social media, people were expressing their anger at the dramatic rise in property values.

In media interviews after the assessment mailout, Service New Brunswick Minister Mary Wilson claimed her government would not profit from the higher assessments and encouraged citizens to reach out to their local government with any concerns regarding the increase in property assessments and the resulting increase in property tax fees.

“They [municipalities] set the rate on what a homeowner will pay because a homeowner doesn’t pay any provincial property taxes at all. There’s no point coming to us,” said Wilson in an interview with the Telegraph Journal.

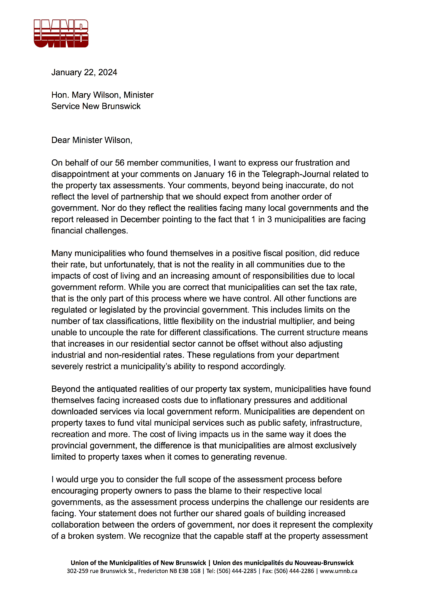

Municipalities across New Brunswick immediately expressed concerns with Wilson’s comments, prompting a letter from the Union of Municipalities of New Brunswick (UMNB) on behalf of municipal governments in the province.

The letter (see below) offered harsh criticism for Wilson’s comments, calling them “inaccurate” and stating that they “do not reflect the level of partnership that we should expect from another order of government.”

The UMNB letter went on to explain the financial challenges many municipalities are facing.

“The cost of living impacts us in the same way it does the provincial government; the difference is that municipalities are almost exclusively limited to property taxes when it comes to generating revenue,” the UMNB letter stated.

That revenue is used to fund “vital municipal services such as public safety, infrastructure, recreation and more.”

The UMNB urged Minister Wilson to “consider the full scope of the assessment process before encouraging property owners to pass the blame to their respective local governments.”

District of Carleton North Mayor Andrew Harvey and other council members were among the municipal leaders who were critical of Wilson’s words, pointing to the fact that the provincial government decides the assessment amounts, a key factor behind any increases in property taxes.

After Mayor Andrew Harvey read the UMNB letter at the Feb. 13 District of Carleton North Council meeting, councillor Chala Watson expressed her frustration.

“I think the fact that our provincial government is telling residents to pass the blame onto another government is not okay. We’re supposed to be working together. You can’t just pass the buck onto the other government,” Watson said.

Councilor Scott Oakes noted significant concerns regarding Minister Wilson’s lack of understanding of the taxation system.

“She doesn’t know how her own taxation system works, which is scary in and of itself. If you’re the minister in charge and you don’t know [how it works] and you make false accusations or say something that isn’t true, there’s a problem,” he said.

Oakes’s comments alluded to Minister Wilson’s claims that the province does not profit from increased property assessment values, which many municipal leaders feel is inaccurate.

Mayor Harvey explained that the province still collects property tax revenue from Local Service Districts or LSDs.

“There are all kinds of businesses and residents outside of the former municipalities. So, if the assessments go up, they benefit from that. What she was saying wasn’t factual at all,” explained Harvey.

When asked if the District of Carleton North property tax rates would rise, Mayor Harvey said he was pleased to say that almost all areas in the district would not see an increase. Still, he added, any rise residents see in property taxes would be due to the increased assessment values, which is a provincial responsibility.

The area within the former municipality of Florenceville-Bristol will be seeing a slight increase of $0.05 per $100 assessed value; however, he noted that prior to this, the tax rates for Florenceville-Bristol had not been increased in many years.